Our latest app is a personal finance app, helping you track the most important number in regards to your wealth – networth.

(We know net worth is the correct English spelling, but we prefer to use it as one non-breaking word.)

What is networth?

NETWORTH = ASSETS - LIABILITIES

Sum up all your assets. Sum up all your liabilities. The difference is your networth.

It is how much money you truly have.

A simple and beautiful formula.

Companies track their “networth” all the time, in the form of quarterly earnings report. Under a company balance sheet, the networth of a company = equity, using the exact same formula.

You should track yours too.

How people track their personal finances?

There are many personal finance apps. The most popular kinds are expense trackers, such as Toshl, Wally, and Money Lover.

However, we find such apps to be very difficult to use because entering every expense transaction is tedious.

I could easily have 10 transactions in a day.

Some apps do have the capability to sync automatically. That’s because some banks provide open API for reading bank’s data. Those without direct open API? Some apps resort to dirty web scrapping, using your log in credentials, at your huge risks.

Syncing comes with lots of security concerns.

Using a Spreadsheet

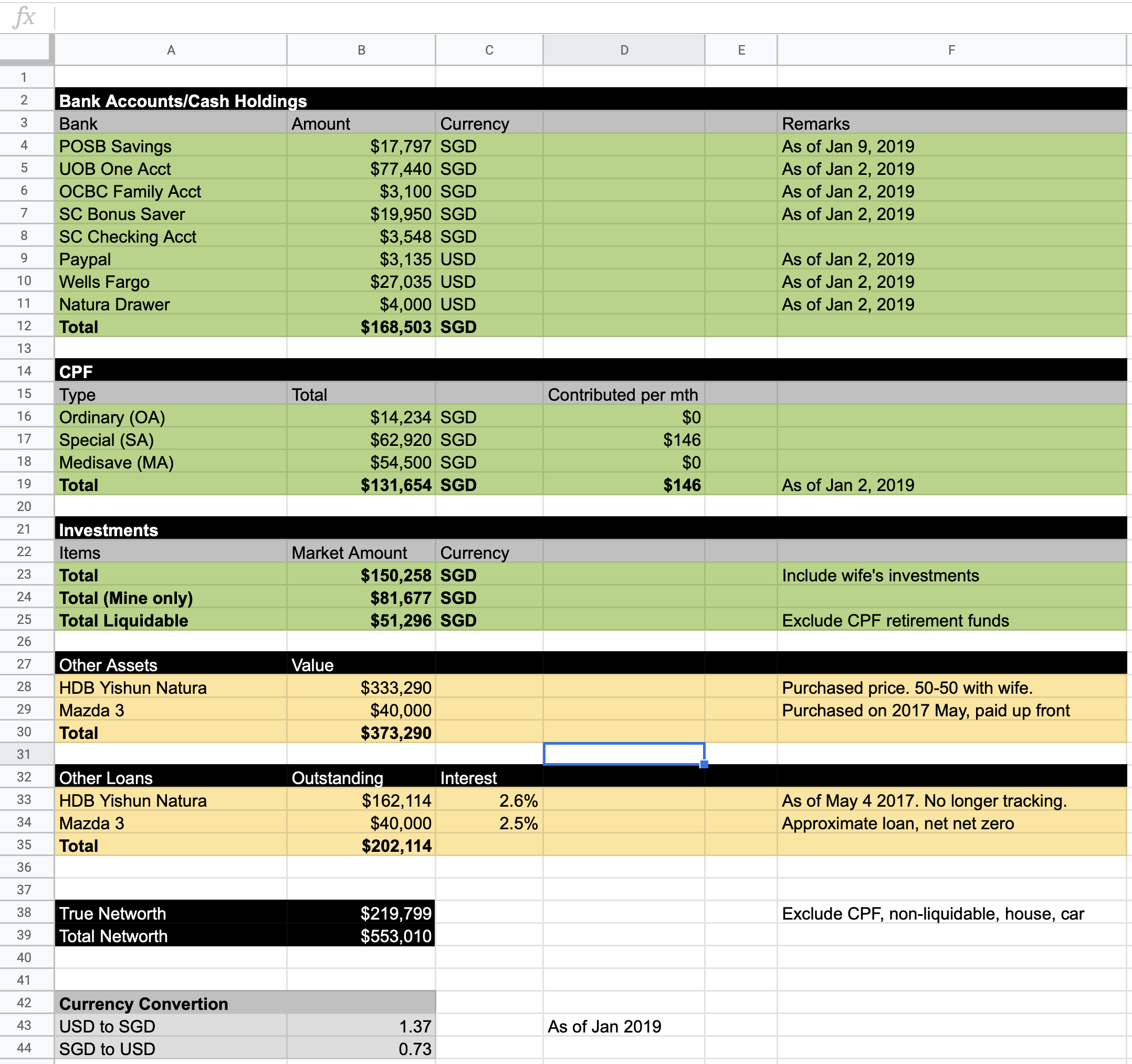

While I don’t use an expense tracker, I use a Google Spreadsheet to track all my accounts and balances.

This is similar to DoughRoller, though he uses a combination of expense trackers + Spreadsheet.

We all use the spreadsheet to update our assets & liabilities, once every month.

Why does one still need a spreadsheet?

- Flexibility - Easily evolve as needed eg. joint account, disregard certain investment

- Big Picture - Shows all the accounts and money in 1 place

I have a real life example.

Above is my very own personal finance spreadsheet that I maintained since 2013. Certain figures & accounts are edited for my privacy (:

Over the years, it becomes complex to maintain, because currency rates will change. My “personal accounting” methodology change over time too.

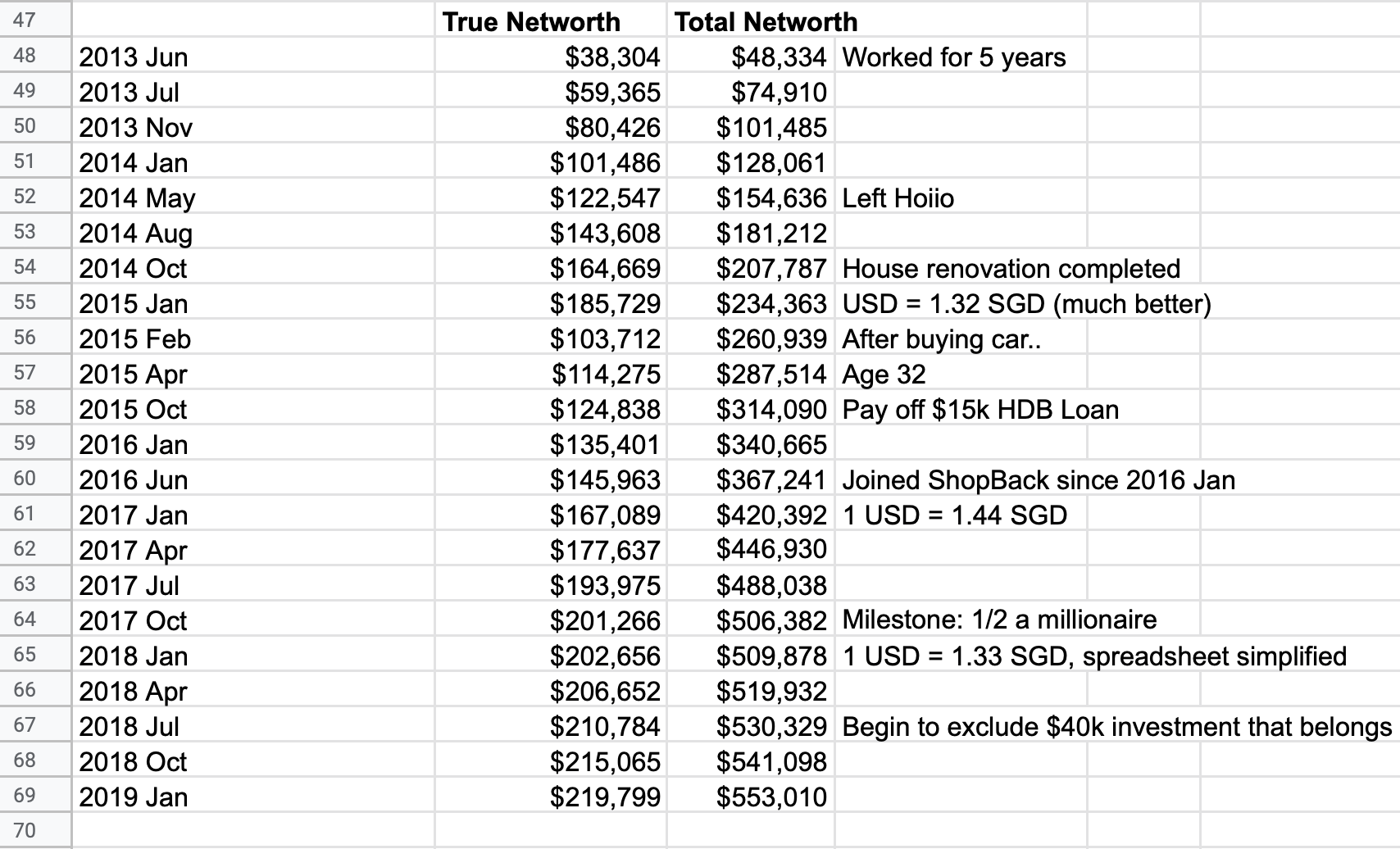

Every few months, I will also note down (copy) the networth, so that I can see the growth over the years.

The rightmost column is notes for certain drastic effects, such as how I calculate or include/exclude certain accounts. I also update exchange rate ad-hocly.

True Networth is a concept that I invented to exclude my retirement funds and illiquid assets/liabilities.

I believe I can do better with an app.

Therefore an app

At Just2us, we build apps that we want to use.

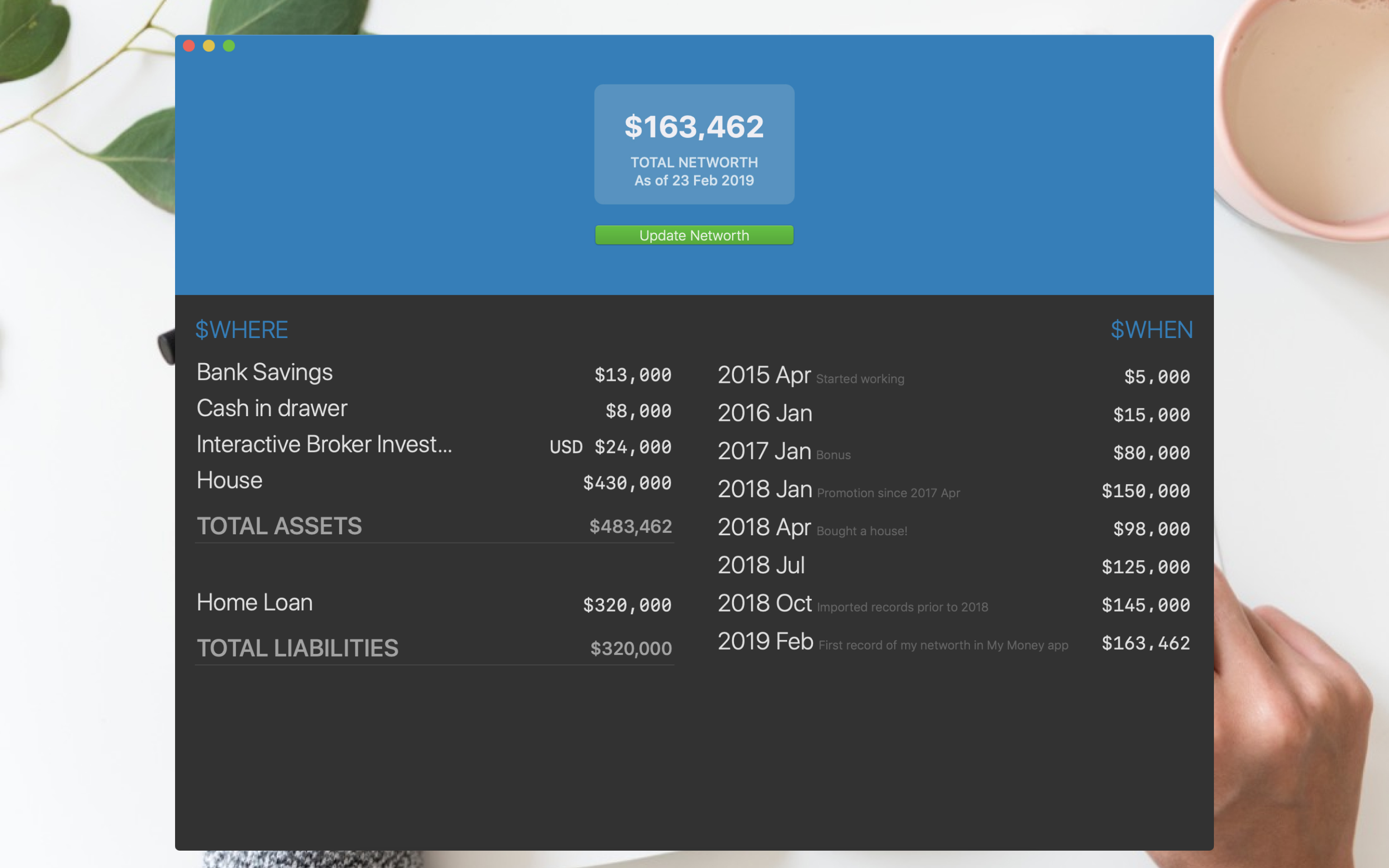

My Money replaces the spreadsheet, and achieve the same flexibility and big picture that a spreadsheet provides.

The dashboard provides the overview of

$WHERE- the accounts and latest balances$WHEN- the networth history

Exchange rates are taken care of automatically! It will be updated yearly (by default), or you could update whenever you want. You may even use custom “currency”, such as BTC if you need it!